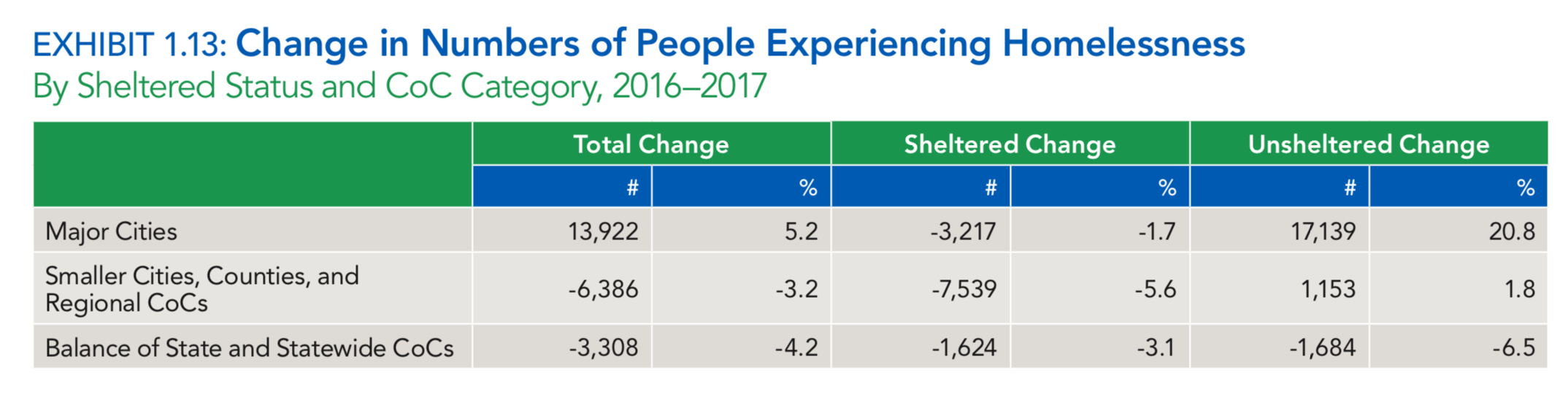

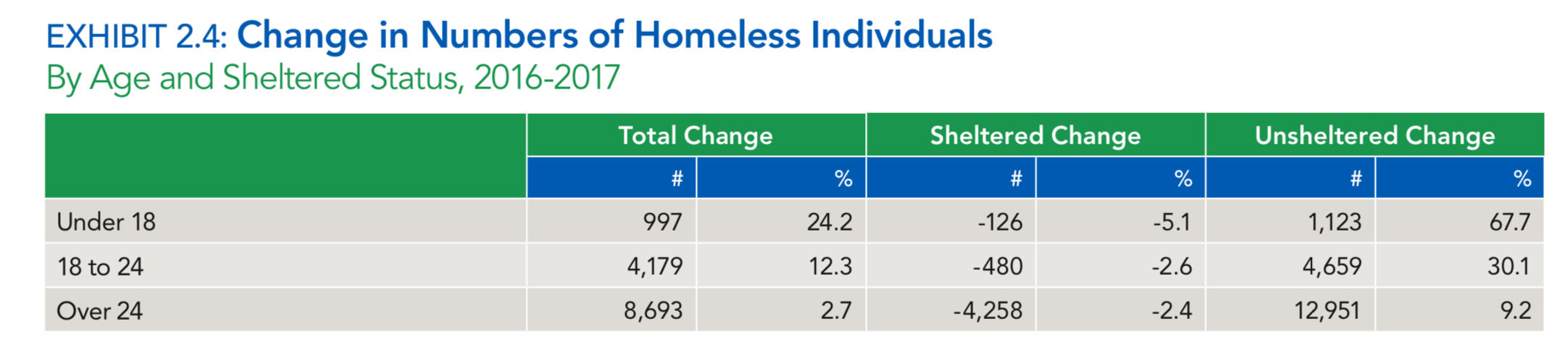

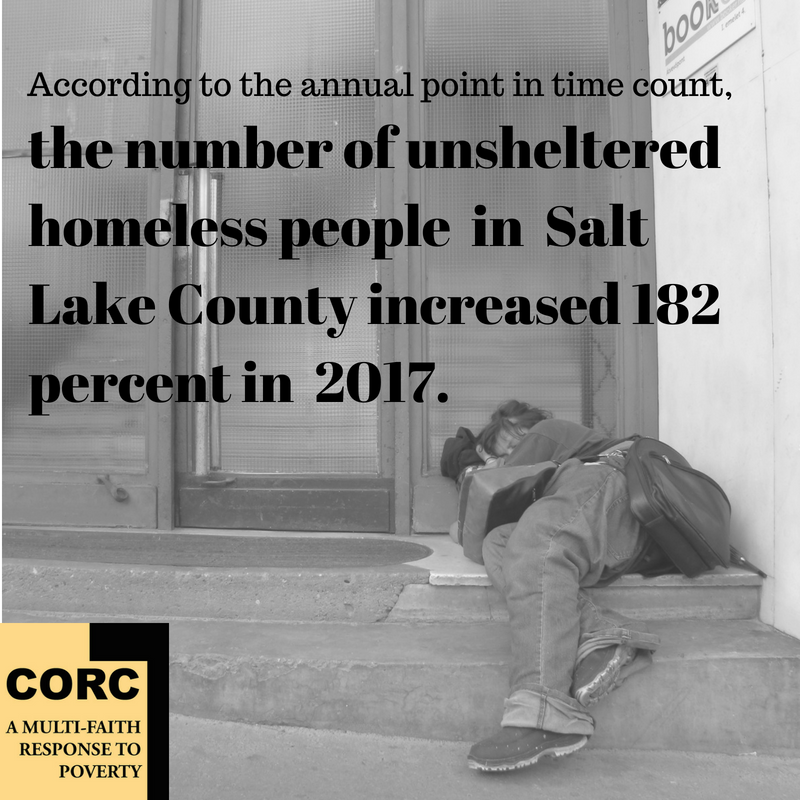

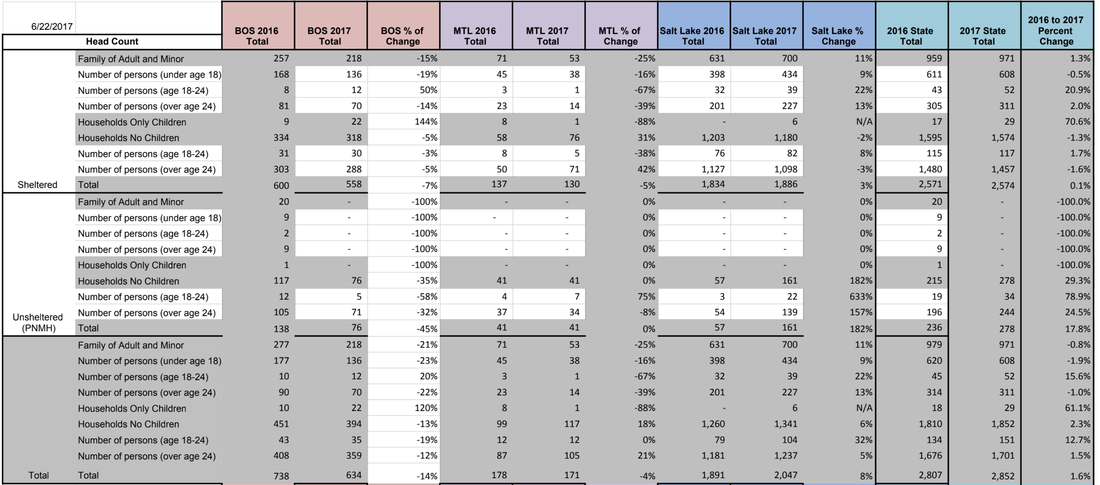

| by Bill Tibbitts, Coalition of Religious Communities Director In major cities across the country the number of homeless people who are sleeping outdoors increased by 20.8 percent in 2017. Alarmingly, the fastest growing segment of the unsheltered homeless population was children under the age of 18-- the total number of whom increased by 67.7 percent. Salt Lake County has historically done a very good job at finding a place for homeless people to sleep indoors but that has begun to change. We only try to count all the homeless people in Utah one time per year, in January, when cold temperatures push people to find a place indoors. In 2017 the number of people sleeping outdoors in Salt Lake County increased from 57 to 161. That is an increase of 182 percent. If the unsheltered homeless population grew at that rate for three more years there would be 965 homeless people sleeping on the streets in the winter of 2020, Fortunately, it appears that the national trend of increased unsheltered child homelessness has not come to Salt Lake County yet. Child homelessness increased by 9 percent in 2017 but the number of unsheltered |

homeless children remained zero. However, if the housing crisis continues to increases the number of homeless children how long can we expect that to remain true? Our elected officials are not addressing this problem. The current family shelter is full and other programs to help homeless families are running at full capacity. Virtually all of the new housing being built to address homelessness is for single people, not families with children.

Unfortunately, it appears that the housing crisis is getting worse at an accelerated pace. On May 22, 2018, the Salt Lake City Council received a presentation on the need to preserve existing affordable housing that included the following paragraphs showing that in 2016 and 2017, over 6,000 apartment units were sold in Salt Lake City to new owners who financed the purchases in ways that will require increased prices for rent. We are nowhere close to building new affordable housing units as fast as we are losing them.

In 2016, there were 52 multifamily properties sold in SLC that contained 4 units or more per Costar data, representing 4,020 units. The median property size was 18 units. Where pricing information is known, the median price per unit was about $93K. The median cap rate (the relationship between NOI and Sales Price) was 5.6.

In 2017, there were 35 multifamily properties sold in SLC that contained 4 units or more per Costar data, representing 2,083 units. The median property size was 24 units. Where pricing information is known, the median price per unit was about $114K (a 23% increase over 2016). The median cap rate was 5.4.

Key takeaways:

Unfortunately, it appears that the housing crisis is getting worse at an accelerated pace. On May 22, 2018, the Salt Lake City Council received a presentation on the need to preserve existing affordable housing that included the following paragraphs showing that in 2016 and 2017, over 6,000 apartment units were sold in Salt Lake City to new owners who financed the purchases in ways that will require increased prices for rent. We are nowhere close to building new affordable housing units as fast as we are losing them.

In 2016, there were 52 multifamily properties sold in SLC that contained 4 units or more per Costar data, representing 4,020 units. The median property size was 18 units. Where pricing information is known, the median price per unit was about $93K. The median cap rate (the relationship between NOI and Sales Price) was 5.6.

In 2017, there were 35 multifamily properties sold in SLC that contained 4 units or more per Costar data, representing 2,083 units. The median property size was 24 units. Where pricing information is known, the median price per unit was about $114K (a 23% increase over 2016). The median cap rate was 5.4.

Key takeaways:

- The multi-family market is heating up, with properties becoming increasingly valuable to investors

- Cap rate declining shows that investors are valuing assets based on potential rents not in place rents

- These factors put pressure on the NOAH and at-risk restricted properties which are viewed as “value add” by buyers whose plan would be to significantly raise rents

Data from Utah's 2017 Point in Time Count. Data from the 2018 count is still not available.

Data from Utah's 2017 Point in Time Count. Data from the 2018 count is still not available.